4 brokerages have issued 1-year price objectives for Starwood Property Trust’s stock. On average, they predict the company’s share price to reach $21.70 in the next year. This suggests a possible upside of 3.4% from the stock’s current price. View analysts price targets for STWD or view top-rated stocks among Wall Street analysts. A look into three diverse real estate investment trusts you can buy today.

- Starwood Property Trust’s target market is institutional investors, high-net-worth individuals, and family offices.

- This suggests a possible upside of 3.4% from the stock’s current price.

- Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes.

- And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

- The company’s portfolio comprises a range of commercial real estate debt investments, including senior and subordinate loans, mezzanine debt, preferred equity, and CMBS.

More value-oriented stocks tend to represent financial services, utilities, and energy stocks. Starwood Property Trust has a strong financial position, with solid revenue and profit margins over the past few years. The company has reported strong revenue and income numbers annually for several years. The company’s debt levels are manageable, and Starwood Property Trust has also maintained dividend payout ratios higher than the industry averages.

Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Another risk facing the company is the potential for a downturn in the real estate market. While Starwood Property Trust primarily invests in debt investments, a significant decline in the value of real estate assets could reduce the value of the company’s loans and securities. The company has taken steps to mitigate this risk by underwriting high-quality loans and maintaining a diversified portfolio of investments.

Starwood Property Trust (STWD) Gains But Lags Market: What You Should Know

4 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for Starwood Property Trust in the last twelve months. The consensus among Wall Street equities research analysts is that investors should “moderate buy” STWD shares. Another growth opportunity for Starwood Property Trust is to expand its presence in the alternative real estate investment space. The company has already begun to diversify its portfolio to include some healthcare and infrastructure properties, and there is potential for further expansion in these areas. Rising rates have hit the real estate investment trust sector particularly hard over the past year. Several leading advisors and contributors to MoneyShow.com, however, have taken a contrary view on t…

The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time.

How do I buy Starwood Prop Trust (STWD) stock?

The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. One share of STWD stock can currently be purchased for approximately $20.99. Starwood Property Trust’s stock was trading at $18.33 on January 1st, 2023.

4 NYSE-Traded REITs Paying 3% Dividends – GuruFocus.com

4 NYSE-Traded REITs Paying 3% Dividends.

Posted: Thu, 14 Sep 2023 17:34:25 GMT [source]

Real estate investment trusts offer investors greater dividends than your average stock as long as it is understood that levels of risk are likely higher. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

The company has taken steps to mitigate this risk by managing the duration of its assets and liabilities and maintaining a diversified portfolio of investments. One of the key growth opportunities for Starwood Property Trust is to expand its commercial real estate debt investment portfolio. The company has a strong track record of underwriting high-quality loans and has demonstrated the ability to generate attractive returns for investors. The company is also well-positioned to take advantage of any market dislocations in the real estate debt market. Starwood Property Trust operates in the highly competitive commercial real estate finance industry.

Research & Ratings Starwood Property Trust Inc.(STWD)

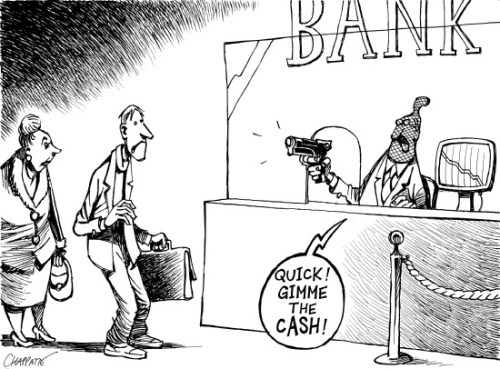

As if concerns over banks’ liquidity weren’t enough to rattle investors, analysts have been raising concerns about the U.S. commercial real-estate market, especially for office buildings. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. © 2023 silo mentality meaning Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.

Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. Starwood Property Trust’s stock is owned by many different institutional and retail investors. Insiders that own company stock include Andrew Jay Sossen, Barry S Sternlicht, Jeffrey F Dimodica and Kevin M Murai.

There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. We’d like to share more about how we work and what drives our day-to-day business.

This represents a $1.92 annualized dividend and a dividend yield of 9.15%. According to 5 analysts, the average rating for STWD stock is “Strong Buy.” The 12-month stock price forecast is $20.9, which is a decrease of -0.43% from the latest price. STWD on Wednesday reported a 24% fall in fourth quarter profit after paying higher taxes. The Connecticut-based property investment company made a quarterly profit of $92.6 million, or 35 cents… A quarterly cash dividend of $0.48 per share of Class A Common Stock.

Starwood Capital Group Launches Starwood Impact Investors

The company’s competitive advantage lies in its expertise in sourcing and underwriting complex commercial real estate transactions. The company’s portfolio is diversified by asset class, geography, and borrower, which helps to mitigate risk. The company’s primary competitors include other commercial real estate finance companies and traditional lenders such as banks and insurance companies. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

5 employees have rated Starwood Property Trust Chief Executive Officer Barry S. Sternlicht on Glassdoor.com. Barry S. Sternlicht has an approval rating of 100% among the company’s employees. This puts Barry S. Sternlicht in the top 10% of approval ratings compared to other CEOs of publicly-traded companies. The company has been pursuing acquisitions to diversify its portfolio and expand its revenue streams.

- They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

- On average, they predict the company’s share price to reach $21.70 in the next year.

- The company’s portfolio is diversified by asset class, geography, and borrower, which helps to mitigate risk.

- 5 employees have rated Starwood Property Trust Chief Executive Officer Barry S. Sternlicht on Glassdoor.com.

- During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks.

Since then, STWD stock has increased by 14.5% and is now trading at $20.99. Starwood Property Trust’s valuation aligns with industry peers, with a price-to-earnings ratio and price-to-book ratio similar to others in the industry. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. A look into three high-yield stocks and why they belong among the best of the best. The technique has proven to be very useful for finding positive surprises. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity.

The company organizes its activities into Commercial and Residential Lending Segment, Infrastructure Lending Segment, Property Segment and Investing and Servicing Segment. The former acquires and finances first mortgages or mortgages with primary lien positions. The collateral for these mortgages is mainly office and hospitality properties in the American West and Northeast. Starwood’s Investing and Servicing unit primarily generates revenue from the acquisition and sale of commercial mortgage-backed securities. One of the main risks facing Starwood Property Trust is the potential for rising interest rates. As a company that invests primarily in commercial real estate debt, rising interest rates could lead to higher borrowing costs and a decline in the value of the company’s assets.

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive https://1investing.in/ at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

The company is scheduled to release its next quarterly earnings announcement on Wednesday, November 8th 2023. Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment. Starwood Property Trust’s recent stock performance could have been more solid, with the stock price decreasing by approximately 30% over the recent past. The company has also experienced a decrease in trading volume over the past year, indicating weak investor interest as economic uncertainty becomes a factor. Real-estate investment trusts have had enormous payouts for a long time, but it pays to be discriminating.

Zacks Research is Reported On:

The company’s key customers include the world’s most significant pension funds, insurance companies, and asset managers. Starwood Property Trust has established a reputation for its expertise in sourcing and underwriting complex commercial real estate transactions, and the company has achieved several key milestones in recent years. During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high… Starwood Property Trust announced a quarterly dividend on Thursday, June 15th. Investors of record on Friday, June 30th will be given a dividend of $0.48 per share on Monday, July 17th.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year. These returns cover a period from January 1, 1988 through July 31, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

Company Summary

Starwood Property Trust operates in the real estate investment trust (REIT) industry. The REIT industry includes companies that own and manage income-producing real estate properties, including apartments, office buildings, shopping centers, and hotels. The industry is highly competitive, with numerous players vying for market share. However, Starwood Property Trust has established a solid competitive position in the industry due to its focus on commercial real estate debt investments. Headquartered in Greenwich, Connecticut, Starwood Property Trust was founded in 2009 and has become one of the largest commercial real estate finance companies in the United States. The company’s portfolio comprises a range of commercial real estate debt investments, including senior and subordinate loans, mezzanine debt, preferred equity, and CMBS.

11 Most Undervalued REIT Stocks to Buy According to Hedge Funds – Yahoo Finance

11 Most Undervalued REIT Stocks to Buy According to Hedge Funds.

Posted: Thu, 24 Aug 2023 07:00:00 GMT [source]

Upgrade to MarketBeat All Access to add more stocks to your watchlist. Sign-up to receive the latest news and ratings for Starwood Property Trust and its competitors with MarketBeat’s FREE daily newsletter. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. The company implied it would take advantage of market weakness to go asset shopping. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries.