In this next section we will explore the requirements for what needs to be reported, when, and to whom. One company may be willing to sacrifice margins for market share, which would tend to make overall sales larger at the expense of gross, operating, or net profit margins. This common-size income statement shows an R&D expense that averages close to 1.5% of revenues.

Common Size Cash Flow Statement

In the current year, that balance shifted to 60 percent debt and 40 percent equity. The firm did issue additional stock and showed an increase in retained earnings, both totaling a $10,000 increase in equity. However, the equity increase was much smaller than the total increase in liabilities of $40,000.

How Common Size Financial Statement Differs from Regular Financial Statements

- Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price.

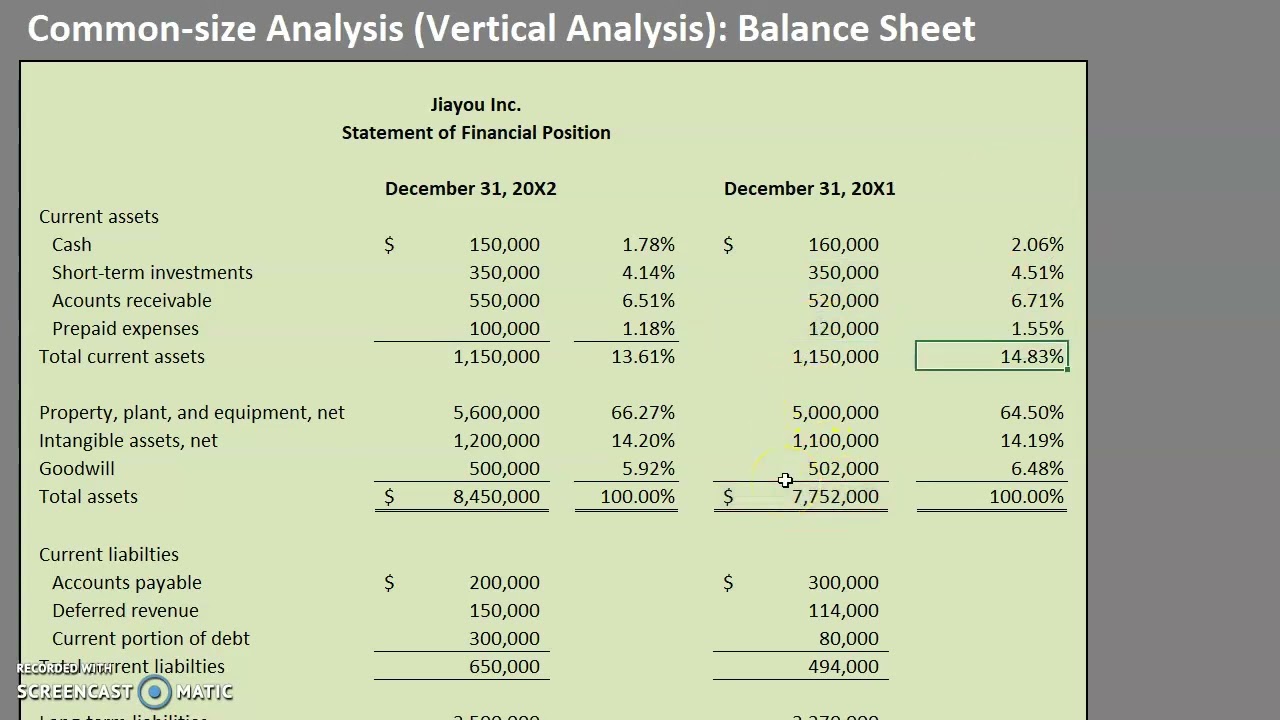

- A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items.

- Vertical analysis relates to analyzing specific line items against the base item, and this is from the same financial period.

- For example, it could be cash flows from financing, cash flows from operations, and cash flows from investing.

The main difference between a normal balance sheet and a common size one is that percentages are included next to the numeric values, showing the proportion of each line item as a percentage of total assets. A vertical common-size balance sheet is a financial statement that expresses each item as a percentage of total assets. Doing so highlights the relative importance of each item on the balance sheet and allows for easy comparison of different categories. This can help financial managers identify trends and make informed decisions about the company’s financial position. Building a common size statement balance sheet is convenient because it helps build trend lines to discover the patterns over a specific period. Still, it also captures each single line item as a percentage of total assets, total liabilities, and total equity besides the usual numeric value.

Types of Common Size Analysis

Balance sheets and income statements may be prepared by taking the following information. Note that although we have compared just two years of data for Charlie and Clear Lake, it is more common to use several years of data to get a more robust view of long-term trends. ABC’s profitability may be lower, but its cash generation abilities cannot be questioned and so bankruptcy risk will be minimal and there will be no shortage of investors trying to get in on the action. And there is no reason ABC cannot reach XYZ’s labor costs over time, which would immediately drive profits up.

This lets you know how much of a cash cushion is available or if a firm is dependent on the markets to refinance debt when it comes due. While regular financial analysis looks at actual values, common size analysis expresses each figure as a percentage, allowing analysts to focus on structure and trends rather than scale alone. Using common size percentages allows you to gain a different perspective of each line item. Or, they can also help show how each item affects the overall financial position of a company. Let’s say that you’re looking into the line items on an income statement for a company. The items include selling and general administrative expenses, taxes, revenue, cost of goods sold, and net income.

Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued. Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

On the balance sheet, analysts commonly look to see the percentage of debt and equity to determine capital structure. They can also quickly see the percentage of current versus noncurrent assets and liabilities. While most firms do not report their statements in common size format, it is beneficial for analysts to do so to compare two or more companies of differing size or different sectors of the economy. Formatting financial statements in this way reduces bias that can occur and allows for the analysis of a company over various periods. This analysis reveals, for example, what percentage of sales is the cost of goods sold and how that value has changed over time. Common size financial statements commonly include the income statement, balance sheet, and cash flow statement.

For this reason, the balance sheet should be compared with those of previous periods. As you can see from Figure 13.6, the composition of assets, liabilities, and shareholders’ equity accounts changed from 2009 to 2010. Common size statements are generally prepared for company income statements and balance sheets. Doing so will help you see at a glance which expenses take up the largest percentage of your revenue. A common-size analysis is unlikely to provide a comprehensive and clear conclusion on a company on its own.

The remainder of that increase is seen in the 5 percent increase in current liabilities. There is no mandatory format for a common size balance sheet, though percentages are nearly always placed to the right of the normal numerical results. If you are reporting balance sheet results as of the end of many periods, you may even dispense with numerical results entirely, in favor of just presenting the common size percentages. You can see that long-term debt averages around 34% of total assets over the two-year period, which is reasonable.

A financial statement or balance sheet that expresses itself as a percentage of the basic number of sales or assets is considered to be of a common size. Common-size analysis, also common size balance sheet example known as vertical analysis, is the process of constructing a financial statement of a common size. The main idea of financial statements is to give information about the business.

The same formula can be copied and replicated in each income statement line, making the calculations much faster. In Figure 5.21, you can see the formulas used to create Clear Lake Sporting Goods’ common-size income statement in Excel. Notice that the $ can be inserted to anchor a cell reference, making it easier to copy and paste the same formula onto many lines or columns.